Hudson Glade Insights: Back to Basics

As children go back to school, and slowly but steadily, workers return to the office, we thought it appropriate to reflect on the economic forecasts and comments we heard over the past few months and how they impact us and the management teams and companies in which we seek to invest. With the persistent talk about possible further rate increases, pausing or pivoting, and the soft or hard landing, we thought it worthwhile to take a longer-term perspective and view.

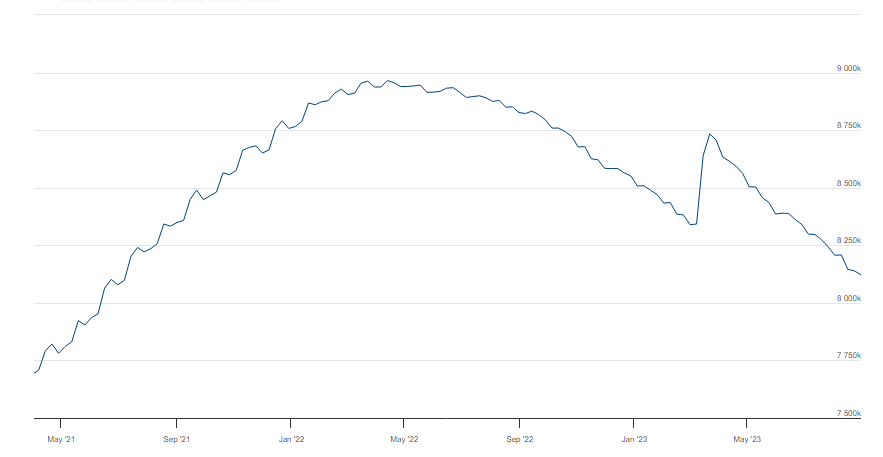

Sometime in early Q4 we expect that the Fed’s balance sheet (just over $8 trillion) will have been reduced back to where it was in April of 2021. See the chart below for a recent perspective.

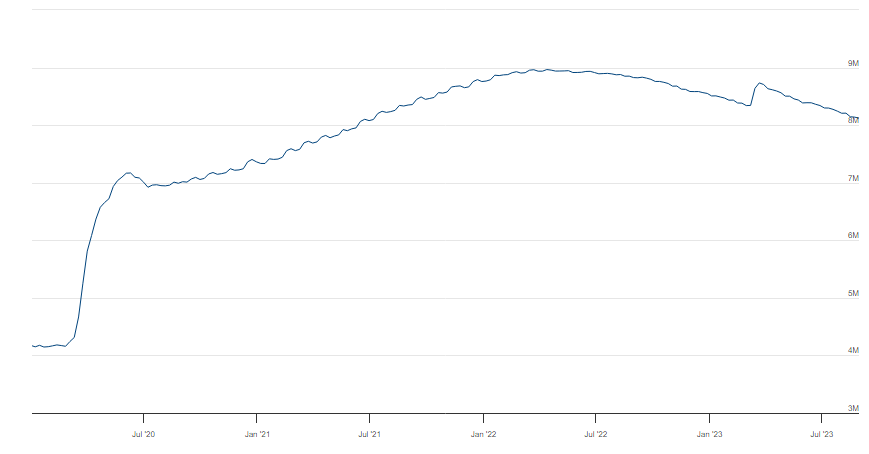

While that may sound like progress, and it is, we estimate it may take as much as five or more years at the current pace of runoff to get the balance sheet back to where it was just prior to COVID. See the chart below for a greater perspective.

What does this mean to us? It means we expect borrowing costs to remain high for quite some time as the Fed simply will not be the buyer of debt that it was for the past few years. We therefore expect rates to stay elevated for quite some time. We think this is healthy and good in the long run as it will drive an appropriate reallocation of capital and resources. What does this mean for most of the CEOs we speak with though? Almost nothing! They have businesses to run and very little of what the Fed does impacts their thinking for the next few years, and it impacts their day to day even less. That said, it certainly impacts PE investors and the markets.

Despite what we expect will be persistently high interest rates (but not that high in a historical context), we remain bullish on recurring revenue businesses benefitting from what we believe is a strong American consumer with a favorable outlook. Employment trends remain solid with unemployment at less than 4% (very much around the level it was at prior to COVID for most of 2019 and early 2020) and labor participation rates increasing. This bodes well for continued spending capacity. We acknowledge student loan repayments are about to start up again and that retailers of many stripes have reported general weakness this past summer. However, as we have mentioned in prior communications, the mismatch between supply and demand for employees should benefit consumers through increasing and stable pay, some disinflation should further help on the margin, and companies offering products that meet the recurring demands of consumers should continue to perform in line with pre-COVID expectations.

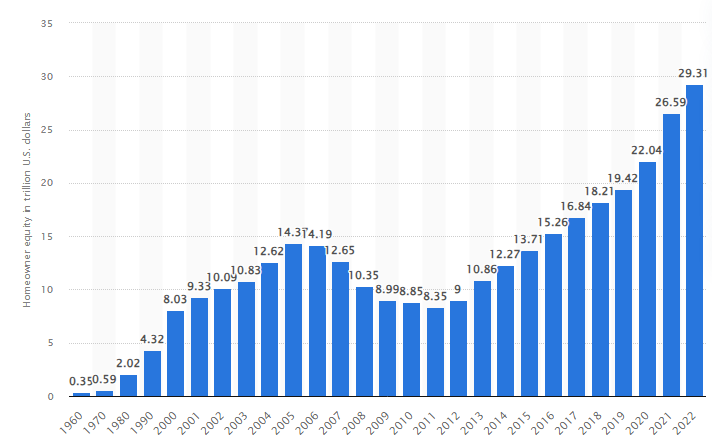

Moreover, as housing remains most American’s largest financial asset, we believe the wealth effect is having a real impact on consumer spending that we think continues to be greatly underappreciated. The lesson of the Great Recession was that housing could be an albatross for many consumers. However, the wealth effect works in both directions, and we believe it is alive and well. When measuring from just prior to the pandemic, the largest asset owned by most Americans increased in value such to increase homeowner equity by ~50%. We think this is having and will continue to have a sustained impact on consumer spending for staple products and services with recurring demand for the foreseeable future.

In addition to our interest in recurring revenue businesses, we believe builders and consumers are adapting to the reality of persistently higher interest rates (by building smaller homes in the case of builders and accepting the reality of the higher cost of capital and purchasing lower value homes in the case of consumers). Furthermore, with many current homeowners locked into low mortgage rates and therefore their homes, we believe homeowners will likely own their homes for much longer than they have in the past and this too will present investment opportunities.

One last area we have spoken about with many but want to highlight is the fundamental nurse shortage combined with the steadily increasing aged population will provide one of the most fundamental tailwinds in any industry over the coming decade. It is estimated over 1 million nurses will retire before 2030 and that more than 175,000 nursing positions will be needed each year between now and then.

At Hudson Glade we try to block out the market noise and simply look to identify solid performing businesses with fundamental tailwinds that seek a partner to help them scale. For many reasons, including those highlighted above, we continue to be interested in recurring revenue consumer driven businesses, non-discretionary consumer products and services with a particular focus on food and beverages, and personal and health care services. Should you want to discuss anything mentioned herein further, please do not hesitate to reach out.

This Insight expresses the views of the authors as of the date indicated and such views are subject to change without notice. Hudson Glade LLC (“Hudson Glade”) has no duty or obligation to update the information contained herein. Further, Hudson Glade makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

This Insight is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Hudson Glade believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

This Insight may not be copied, reproduced, republished, or posted in whole or in part, in any form without the prior written consent of Hudson Glade.